The Truth About Risk

The Truth About Risk

Since beginning Your Best Path Financial Planning, I have learned that what clients want is to SEE their finances better. To me, this means I must

Simplify for them,

Educate them, and

Empower them.

To that end, the set of principals I would like to describe revolves around the truth about RISK. I'll admit we can't simplify everything about the subject. But if you have no system to detect and classify investment risk now, I promise you will have that ability when you finish reading. You will gain some insight into how to frame risk, and you will be prepared to act on that knowledge.

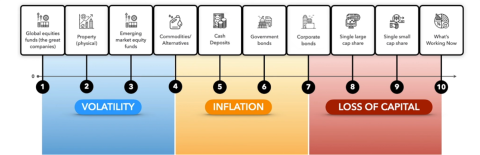

There are many sources of risk in our lives. I will be writing about financial risk and ignoring other risks such as accidents and health risks. To narrow the topic a little further, some financial risks, such as "sequence of returns risk" or disaster risk, will not be discussed here because we are focusing on investment risks. The three types of risk I want to focus on today are Volatility, Inflation, and Loss of Capital.

Why these three? Because these are the risks that differ among types of investments, when we finish, we will have a framework to figure out which types are best for you.

At least one of these three risks below applies to all investments, so let's define them and give you an image to help you remember each one.

Volatility is what we call it when the value of an asset (what you can sell it for) changes unpredictably. The thing to remember about volatility is that it's all about when you get out (sell the asset). The price goes up, and the price goes down. It's like being on a roller coaster - if you try to get out at the wrong time - disaster. When you buy a volatile asset, you get compensated for the fact that you might not be able to sell it for the price you want when you want to. Just like a roller coaster returning to the station, investments that have negligible inflation risk and negligible loss of capital risk eventually return to a price point where you can sell for a profit. The fact that these investments can be improved by human effort makes it possible for them the return to the station more valuable than when they started.

Inflation is what happens when the price of goods and services go up gradually over time. Inflation is more dangerous to investments than volatility because you cannot mitigate it by choosing the correct exit point. A fixed cash flow that does not change over the years will become increasingly worth less and eventually worthless (in an inflationary environment -- which we live in almost all the time). Like an ice sculpture at a wedding, your investment will eventually shrink down to an unrecognizable lump. It may happen fast like on a warm spring day (like in the 1970s) or slowly like on a brisk October evening (remember the 2010s), but it will happen.

Loss of Capital is the most dangerous type of risk - permanent and irrevocable loss. It is the possibility that the value of your asset could go to zero and stay there. Like a turkey the week before Thanksgiving - there may be a Presidential pardon, but when the end comes, it's truly over. Death is the worst thing that can happen to a living thing, and loss of capital is the death of your investment.

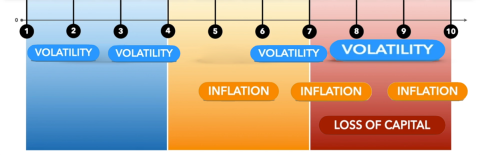

Before we move on, I believe it will be helpful to clarify one point, which I have tried to illustrate below.

Volatility applies to all the investment types (except #5, as you will see in a few paragraphs), and inflation applies to #5-10. The basic form of this illustration presented first simply highlights the most dangerous risk.

Investment Vehicles On the Continuum of Risk

Where do the common types of investment fall on this risk representation? Here is my carefully considered opinion. Reasonable people can have different ideas, so I will go through and explain my reasoning for each one.

10. The riskiest investment is "What's Working Now." What I mean is, these assets are the opposite of what always (as far as the history of capitalism) has worked. I am talking about fads, such as cryptocurrencies, peer-to-peer, collectables, traded endowments, secret formulas, etc. I would never advise a client to invest their hard-earned family savings in an asset type without a very long track record across different economic climates.

9. The next riskiest investment is one small company's stock offering. Yes, you might make a substantial gain this way. But there is always the risk that a single company can go bankrupt, which makes you the Thanksgiving Turkey.

For clients that come to me with a lot of assets, I don't insist that they sell individual company shares that they may have chosen – if they comprise only a minimal portion of their overall portfolio. Picking stocks is an intellectual challenge that some people can't resist, so if you must do it, I can't stop you.

But I am a fiduciary, and that means I have a duty of competence and therefore won't pick stocks for your life savings. The only people that are genuinely competent to do so are those with the CFA (Certified Financial Analyst) designation. It is one of the most challenging tests to pass, rated nearly as difficult as the top-level actuarial exam. Most CFAs work for mutual funds, hedge funds, and other Wall Street institutions or their regulators. Any advisor that is not a CFA but is picking stocks for clients does not deserve your business.

8. The next riskiest investment is one large company's stock offering. It's the same story as #9 but with a bit less risk and also less potential gain. You may think that large companies don't go bankrupt, but they do. Remember Fannie Mae, Worldcom, Enron, Pets.com, Pan Am, Lehman Brothers, Washington Mutual, etc.? All of them were once dominant in their industry. Yet, their common stock eventually went to zero, or they were taken over by competitors at pennies on the dollar.

7. The next riskiest investment class is Corporate Bonds. When you buy these bonds, whether in a bond fund or as directly purchasing a bond, you are lending money to a corporation. In exchange, you get their promise to pay you interest for some time and repayment of your principal at the end of the bond term.

Corporate bonds are rated by various independent rating agencies from AAA (or Aaa) to D. A and B rated bonds are considered "Investment Grade." The rest are called "Speculative Grade" or "Junk bonds." The lower the rating, the closer you are to Loss of Capital territory. In a bond fund, you will never lose all of your capital, but you may lose some of it if a company in the fund defaults on payment of their debt.

All bonds carry inflation risk because while the interest rate on a bond is fixed for the duration of the bond, inflation could increase while you are holding it. That would erode the value of your investment.

All bonds also carry volatility risk because its price (value) is determined in part by a comparison between the interest rate it pays and other interest rates that change over time. As interest rates, in general, go up, bond prices go down, and as interest rates go down, bond prices go up. If your old bond pays 3% and new bonds being issued pay only 2%, your bond is better, and its value rises.

All bonds, corporate and government, carry inflation risk, and that risk acts indirectly. When inflation goes up, other interest rates go up because the inflation rate is normally priced-in as a starting point for all other rates. And the value of a bond goes down when available interest rates go up. Here's an example.

Let's say inflation is running at 2%, and you have a AAA corporate bond that pays 3% for 10 years. Your bond has a spread of 1% over inflation. Next year inflation goes up to 3%. Now that same company and others like it will be issuing new debt at 4% to maintain the 1% spread over inflation. No one wants to pay the same price for your 3% bond, so its price goes down. Your investment has lost value because of inflation. The exciting thing about bonds is that unlike cash, when inflation declines, their value goes up rather than just eroding more slowly.

6. The next riskiest investment class is Government Bonds. There are several flavors of Government Bonds: I-bonds, T-bills (short term, < 1 year to maturity), Treasury Notes (1-10 year maturities), Treasury Bonds (10-30 year maturities), Municipal (muni) bonds issued by State or City governments, and so on. Note that while munis are a different asset due to their tax advantage*, their risk profile is very similar to Federal Government Bonds.

These bonds are further away from the Loss of Capital section because they are backed by an authority that can collect taxes to pay the obligation; however, their inflation risk and volatility risk are the same as for Corporate Bonds. Munis are riskier than federal Treasuries because states and cities are limited in their taxing ability and have occasionally defaulted on their bond payments.

*Interest on municipal bonds is not subject to federal taxation, and if you live in the jurisdiction of the issuer, you often get a state or local tax break as well.

5. The next riskiest investment class is Cash Deposits. Cash has the most inflation risk of any investment, but I am rating it as less risky than bonds because bonds also have volatility risk. Cash has no volatility risk. Inflation is the only risk with cash, but it is inevitable. Cash is only a parking place for money you are going to invest when the time is better, or you are going to spend later as you are in retirement. The risk of cash is 100% known, but that does not make it non-existent.

4. The next riskiest investment class is Commodities. Oil, steel, soybeans, iron, corn, gold, copper, aluminum, and silver are the most traded commodities. A commodity is a product in which every item is identical, which means that unlike equities or real estate, it cannot be improved. Unlike cash, commodities are resistant to inflation. The problem is that they are the most volatile - their production often fluctuates due to political events and trade disputes, which can't be predicted in any reliable or systematic manner. Finally, most of us are not using the commodity in our business. Therefore the value of a commodity is in the speculation that we can get someone else to pay more for this thing (which I can't make any better) in the future.

3. The next riskiest investment class is diversified emerging markets equity funds. These are well-diversified mutual funds or Exchange Traded Funds (ETFs). The volatility in emerging markets is more significant than in developed markets for many reasons too numerous to list exhaustively. It is higher because governments in those countries do not have the institutions to regulate issuers as effectively as in developed nations. Companies there have less transparency in their reporting, less protection from government seizure, and a weaker legal system to protect property rights. Perhaps most important, countries with smaller economies do not attract investment as consistently as larger ones.

2. The next riskiest investment class is Property (physical), i.e., land or real estate. Land is a commodity, or more precisely, one of a few commodities - farmland, residential land, urban land, etc.. But real estate also has the advantage of being readily improved by appropriate investment. Real estate is resistant to inflation due to its limited supply. Still, its value is volatile because it is influenced by the relative strength of other available investments, changing demographics, and the specifics of its location.

1. The least risky investment class is diversified developed market equity funds, particularly US equity funds. These are well-diversified mutual funds or Exchange Traded Funds (ETFs). The volatility in developed markets is lower than in emerging markets for all the reasons listed in section 3 above. Among developed nations, the US still has the most robust regulatory institutions, the most transparent reporting requirements, the best legal system for the protection of property rights, and is simply the biggest economy in the world. For those reasons, I believe it is the least risky market for investment in equity funds.

So what do we do with this knowledge?

I recommend that all clients steer clear of "What's Working Now, and single company stocks (10, 9, and 8). Why take on the loss of capital risk, which you are not qualified to assess, if you don't have to? As for commodities, there is no loss of capital risk and minimal inflation risk, but the volatility risk is overwhelming. Let me just repeat that they can't be improved, and their value can't be predicted in any reliable manner. If you have $25 million and want to venture into hedge funds, let them pick stocks and commodities. With less money, we don't have the resources to hire the right experts and ride out the volatility cycles that may last more than a lifetime.

If they can tolerate the volatility, all clients should invest in equity funds with some real estate (usually your home) to add in extra inflation resistance. This is where to invest. Use the principles discussed elsewhere – minimize your costs, dollar-cost averaging, avoid behavioral mistakes (fear and greed), pay attention to diversification, asset allocation, and asset location, etc. All other considerations should be geared toward making these core investments work better for your distinct situation.

To that end, the function of bonds (and sometimes cash) is to lessen the overall volatility of a portfolio to a level that the client can tolerate. Equity fund profits are not correlated with bond fund prices. Sometimes they go up or down together, but usually, significant moves are unrelated. That smooths out returns for a less bumpy ride.

Finally, my advice to everyone is this.

Once you have won the game, stop playing.

If you have enough money to have the great life you want, take as much risk out of your portfolio as you can. How much is enough? A fee-only financial planner that puts life in the middle of your plan can help you figure that out. Your best path is unique to you, so honest discussions of what a great life looks like to you is the way to uncover it. Let's have that conversation and get you on the path to a great life.

I hope you found this information useful. Please call me at any time to talk or use the link below to schedule a conversation.

All the Best!

Gordon Achtermann