Weekly Market Insights: Hawkish Fed; Stocks Retreat

A jump in yields sparked by a more aggressive sounding Federal Reserve sent the market lower to start the new year.

The Standard & Poor’s 500 declined 1.87%, while the Dow Jones Industrial Average fell 0.29%. The Nasdaq Composite index was hardest hit, dropping 4.53% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slipped 0.55%.1,2,3

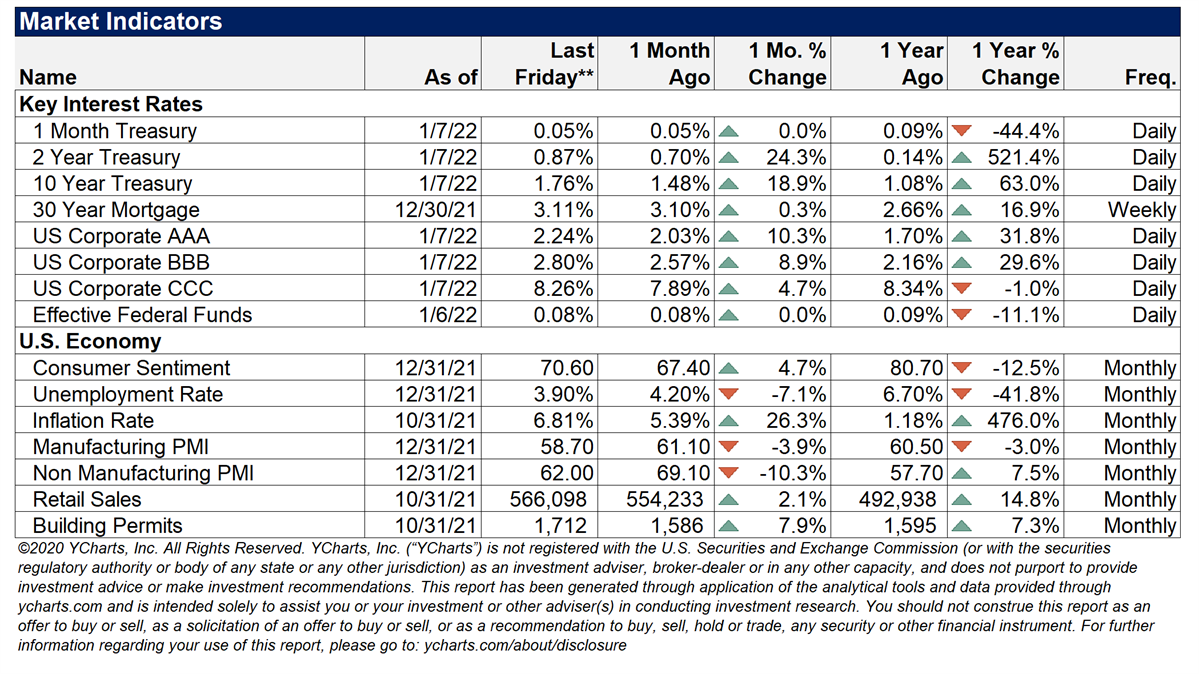

As you can see below, all interest rates are up in the last month except the Effective Federal Funds rate which is unchanged.

As everyone probably knows, inflation has gotten worse but unemployment has gotten better. Consumer sentiment rebounded a bit this month (up 4.7%) which may have helped retail sales which are also up (2.1%).

Two relatively under-the-radar statistics are the PMI numbers (PMI = Purchasing Managers Index.) These are surveys of purchasing managers who are asked about their future plans. A score of 50 means no change, anything above 50 means the surveyed individuals are increasing purchases. Although both are down from last month, the Non Manufacturing survey is still up 7.5% from a year ago and that is the one that reflects a much bigger piece of the total economy.

Finally, the rebound in Building Permits might indicate that the labor shortage in construction is starting to ease.

The Tech Wreck (What happened)

The perception of a more hawkish Fed put a hard stop to the year’s positive start and pushed bond yields higher and stocks into a broad retreat.

Technology and other high-valuation shares were particularly hard hit by rising yields. Even the larger-capitalization technology companies with strong cash flows and profits were damaged. As yields trend higher, investors are questioning if these companies can lead the market in 2022. Fueling this decline was a four-day sell-off of technology companies by hedge funds that, in dollar terms, represented the highest level in more than ten years. Stocks continued to struggle into the final trading day, unsettled by a renewed climb in yields and an ambiguous employment report.4

The Fed’s Surprise (Why it happened)

Minutes of December’s Federal Open Market Committee (FOMC) meeting were released last week and it revealed a more hawkish Fed than investors had been expecting. One surprise was that the first hike in interest rates could occur as early as March. Another, and perhaps more consequential, surprise was the idea of beginning a “balance sheet run-off” by the Fed following the first hike in the federal funds rate.5

A balance sheet run-off means that maturing bonds won’t be replaced with new bonds, the result of which is a smaller Fed balance sheet. Many investors view this step as removing liquidity from the system, a departure from market expectations that the balance sheet would remain flat during the Fed’s pivot to monetary normalization.

My Take

We have known this was coming for quite a while.

There are only two situations that can be happening in the stock market. Either we are at all time highs, or we are off the highs. Most of the time we are off the highs, so most of the time traders are worried about something - and unsatisfied.

Don't be a trader.

If you are saving and adding to your holdings, declines are opportunities to buy at lower prices. If you are spending assets or holding steady, declines are opportunities to rebalance, maybe to harvest some losses to reduce taxes later.

If you are holding more than 5% of your assets in individual stocks, cut it out. You are not a professional.

In 1999 everyone I knew thought they knew how to trade. They didn't (and neither did I.) They were just lucky that everything was going up. Then the NASDAQ lost 25% in a week. The last few years have been similar to the 90's.

The truth is that it's impossible to distinguish skill from luck when the market only goes one way.

I don't think we are near the situation in March 2000, although some of the big growth stocks could certainly go down 25%.

So check your asset allocations and make sure you are prepared for a potential correction and are committed to either weather the storm or have a response plan.

This Week: Key Economic Data

Wednesday: Consumer Price Index (CPI).

Thursday: Jobless Claims. Producer Price Index (PPI).

Friday: Retail Sales. Industrial Production. University of Michigan Consumer Sentiment Survey.

Source: Econoday, January 7, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: Infosys Limited (INFY).

Thursday: Delta Airlines, Inc. (DAL), Taiwan Semiconductor Manufacturing Company, Ltd. (TSM).

Friday: JPMorgan Chase & Co. (JPM), Citigroup, Inc. (C), Wells Fargo & Co. (WFC), BlackRock, Inc. (BLK).

Source: Zacks, January 7, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“Many men go fishing all of their lives without knowing that it is not fish they are after.”

– Henry David Thoreau

Be on the Lookout for Tax Deduction Carryovers

Deductions or credits not used fully one tax year that may be eligible to be carried over into future years include:

- When you have a net operating loss

- When your total expenses for a permitted deduction exceed the amount you’re allowed to deduct in a given year

- When a credit you qualify for exceeds the amount of tax you owe in a year

- Adoption tax credits

- Foreign tax credits

- Credits for energy efficiency

Track these (or have your software do it) so that you don't forget them from one year to the next.

* This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from Credit Karma6

Know Your Numbers

According to the American Heart Association, adults should know their key health numbers, including total cholesterol, HDL (good cholesterol), blood pressure, blood sugar, and body mass index. If you’re not sure what your “numbers” are, schedule a visit with your doctor to monitor them and understand why each is important. Here’s a quick definition of each metric:

- Cholesterol – Cholesterol is a lipoprotein in our body’s tissues that plays a role in forming and maintaining cell membranes.

- Body mass index – Your BMI is calculated using your height and weight, and can help determine whether you’re underweight, at a healthy weight, or overweight.

- Blood pressure – Blood pressure refers to the amount of force the heart must use to pump blood throughout the body.

- Blood sugar – Blood sugar measures the concentration of glucose in the blood.

Tip adapted from American Heart Association7

I’m soft enough to soothe the skin, as well as make rocks crumble. I’m often slippery and on the move. What am I?

Last week’s riddle: I was framed, yet the man who framed me committed no crime. How is this possible? Answer: I’m a picture, and I was put in a picture frame.

Coral colony on a reef in the Red Sea, Egypt.

Footnotes and Sources

1. The Wall Street Journal, January 7, 2022

2. The Wall Street Journal, January 7, 2022

3. The Wall Street Journal, January 7, 2022

4. CNBC, January 6, 2022

5. The Wall Street Journal, January 5, 2022

6. Credit Karma, December 9, 2020

7. American Heart Association, June 24, 2021

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2022 FMG Suite.