Financial Planning

A comprehensive financial plan serves as a blueprint for your financial life.

We will guide you through a discovery process to define your future goals and help you avoid your blind spots (everyone has some).

As your fiduciary, we will focus on the biggest drivers of financial success and work to minimize your investor costs.

A comprehensive plan covers a lot of topics – not just insurance (risk management) and investment planning, but also cash flow analysis, tax planning, retirement planning, estate planning, college funding, life transitions, long-term care planning, employee benefits selection, and other scenario planning.

We will explore your money mindset, which is often a product of your personal history with money, and work to ensure your plan is aligned with your philosophy on money and life.

We will be your accountability partner and make sure you are taking the agreed-upon steps to put your plan into action.

Your Comprehensive Plan Will Include:

1. A beautiful customized plan summary presentation including:

- Your detailed and prioritized action plan covering every topic applicable to your financial situation,

- A snapshot of crucial current values & financial position data,

- A snapshot of critical future steps and goals,

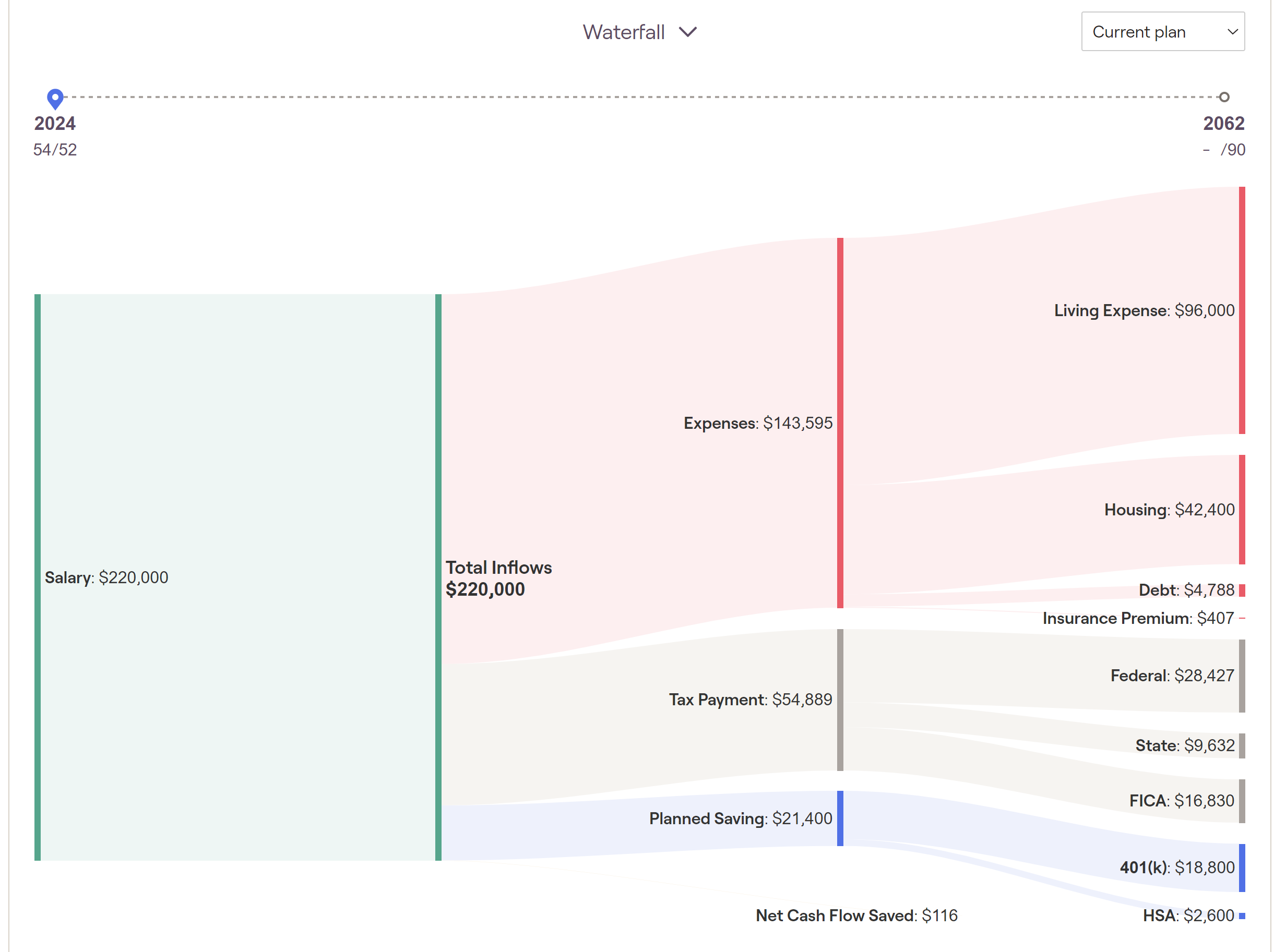

- All your cash flows in one elegant slide,

- A 7-year calendar of important dates.

- Extensive supporting documentation, including detailed cash flow projections and all assumptions underlying those projections.

2. Ongoing access to our client portal:

- The Software – quickly see the effects of a change.

- The Vault – securely share and receive documents with us.

- Securely link accounts – your information is always up to date.

3. My exclusive Safe Retirement System

- Creates retirement spending guardrails,

- Based on rigorous academic research.

4. Analysis of your most recent tax return & integration with your tax plan

5. Our accountability system to keep us both on track.

6. All Comprehensive Plans address every aspect of your financial life.

Our Financial Planning Principles

When choosing a financial advisor, agreeing on a common set of operational principles with your advisor is critical to the relationship’s success. As such, below are our financial planning principles for your review.

To Be Successful, You Must Have a Plan: Just like you don’t get into your car without a destination and an approximate route to get there in mind, financial planning is much the same. To be successful, we must first define what success means to you—to identify your life’s purpose and the financial goals that will support and enable the accomplishment of that purpose. Then we can craft a financial strategy specifically designed to pursue those objectives.

We Are Planning Focused: Many firms are either primarily insurance or investment focused, whereas we are planning-focused. This is because we know that decisions made in one area will impact many others. Thus, we constantly keep your complete financial life in mind to ensure proper alignment between each of your life’s goals.

Financial Planning Is Not Precise; It Is Adaptive: We know that the world (markets, economy) and our personal lives (income, health, family) are ever-changing. A plan that sits on a shelf couldn’t possibly account for all that life will throw at you, so we meet regularly to adjust your plan as needed to reflect the current reality.

We Control the Things We Can Control: We will not pretend to know which way the market will go next, as there are no facts about the future. We believe in controlling what we can control. That is, the amount we save, how long we give our savings to grow, our asset allocation, our behavior, and how we plan for various risks. These are what will ultimately determine your success.

Prepare for What Can Go Wrong; Invest for What Can Go Right: Even the absolute best investment portfolio can be undone if you are unprepared for life’s what-ifs. Examples might include an unexpected death, health issues, accidents, lawsuits, or becoming disabled. Planning for and insuring against these risks allows us to invest for all that can go right. We cannot control what happens to us, so we must be prepared for each of these possibilities.

Good Planning Has a Long Time Horizon: We view every client relationship as a lifelong partnership. This is a significant advantage because our single objective is to provide advice that will (hopefully) result in the accomplishment of your multi-decade goals, and we expect to walk with you every step of the way.

We Follow Our Own Advice: As the steward of many of our clients’ complete financial lives, we believe that we should plan for our own financial lives by using these same financial planning principles. So, that’s precisely what we do.

We sincerely believe that through our collaborative approach and principles-based planning philosophy, you will feel encouraged to pursue what is most meaningful to you.